REAL ESTATE

What we do

As a privately held alternative investment firm, global real estate has been a mission- critical strategy for Net de Gerrers since its inception. During the firm’s history, we have served as a trusted local advisor to institutional investors seeking to opportunistically allocate capital to the Spanish property market.

Our long-standing network of industry relationships provides us with an information advantage for identifying attractive but underperforming assets, which are mispriced due to sub-optimal cash flow or asset complexity. We seek to identify under-managed properties located in prime locations in Spain, and endeavor to unlock their value by implementing best-in-class property management practices.

The real estate team’s experience encompasses all aspects of the investment process including acquisition, financing, leasing, construction management and disposition. Frequently, we source assets from owners who lack the capital, patience or expertise to correct a property’s underperformance. Importantly, our legacy relationships with banks, loan servicers, bankruptcy liquidators and property owners often enable us to source properties in a privately negotiated process.

Since the firm’s inception, NdG has been tasked with a variety of client-specific mandates. We have pursued on behalf of global institutional investors a range of real estate investment strategies across the risk-return spectrum (opportunistic / value-add / NPL’s). In each instance, we have engaged in a research-based investment process which combines our operational expertise and local knowledge with a commitment to hands-on value creation.

Case Studies

Below are a few example case studies of successful projects that exemplify the attributes of our investments and operational management capabilities.

Alcalá de Henares - Large apartment development in Madrid

254 apartment units

‘The challenge of this project was to successfully judge market conditions and the timing of sales to realize the highest returns.’

Fernando Pijoan - Director Of Development & Infrastructure

A: Opportunity / Challenge

We discovered this asset within the portfolio of Sareb with an attractive discount. Alcalá was, at that time, slowly starting to recover, yet there was still a lack of real demand in the market. The area belonged to the famous soap brand GAL, and they sold it for a considerable amount of money to the Spanish real estate developer REALIA, who urbanized it and started to develop it until getting caught by the financial crisis.

The plot is located in an expansion area at a walking distance from the historical center; the city was well-known for a neighboring development that sold at a much higher price. The size of the development, the market timing, and the possibility to secure a top-rated architect made this project a highly attractive prospect.

B: Project / Operations

At the time we bought the plot, it took us a while to explain the local market conditions in Alcalá. In addition, during the due diligence phase, we had to rush to solve and explain to one foreign investor all of the details that could affect the development - such as the soil decontamination from the soap factory - before potentially losing the plot to another bidder. Financing a development this big in two phases was an extra challenge since most of the banks at that time preferred single phases of around 150 units.

During the first phase of development, we could foresee the construction costs rising dramatically and the probability of renegotiations with the contractor increasing, which would have severely impacted the development, and its financial returns.

C: Results / Outcome

The underwriting and acquisition of this project required us to work efficiently under pressure, to provide the right answers in time for our investors, and to secure the project. However, neither of the issues involved was new to us and promptly were solved, especially those regarding the market, the product design, and the due diligence.

Towards the end of the second phase of the development, it was necessary for our team to intervene in the renegotiations opened by the construction company regarding the increases in the construction costs. Having foreseen this during phase one, we were successfully able to renegotiate and prevent a significant overrun in costs.

The experience and agility our team allowed us to take advantage of market conditions and complete a high-end development in a historic town in the province of Madrid that was accepted by the market with excellent sales and superior returns for our investors.

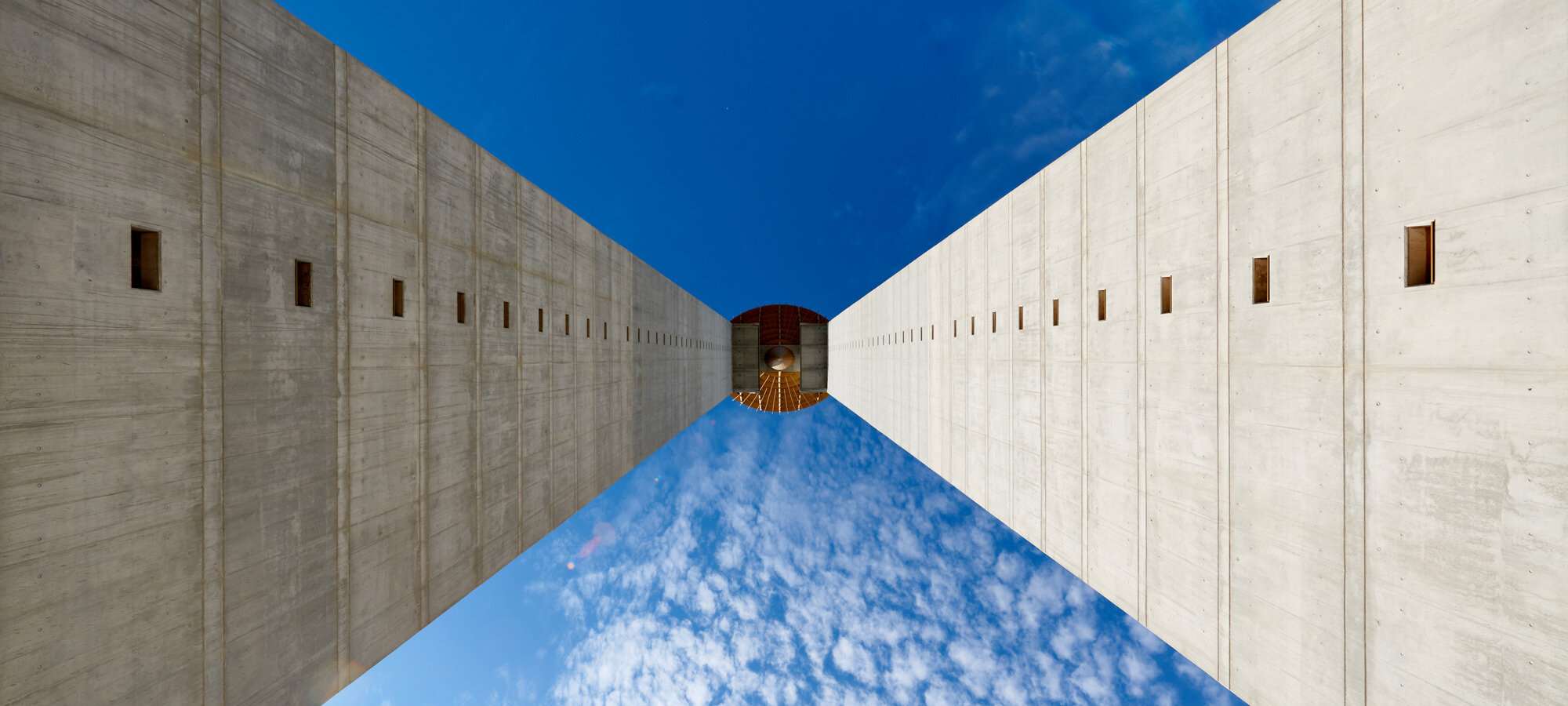

The Intempo Tower

THE MOST VISIBLE NPL IN SPAIN

‘We acquired and managed a complicated and highly visible NPL, and facilitated the re-development of the tallest residential skyscraper in Spain.’

Eduard Navarro - CEO

A: Opportunity / Challenge

The Intempo building is a 47-floor, 198-meter-high residential skyscraper located on Spain’s southern coast in Benidorm. Intempo’s architectural design was officially presented in January of 2006 and ground-breaking occurred the following year. Initially scheduled for completion in 2009, the development was adversely impacted by the Great Financial Crisis (GFC) of 2008, until March 2014, when the original management company was forced into bankruptcy.

In 2018, NdG partnered with a prominent U.S. investment manager for the purpose of acquiring through bilateral negotiation the NPL secured by the Intempo building. The objective was to convert to REO and complete development. Twelve years after the commencement of the original project, we began the transformation of the once-failed project by updating the construction and architectural plans while strategically re-branding the building’s public image.

B: Project / Operations

The process of purchasing the NPL began with negotiations with the original owner/developer. Concurrently, NdG pursued efforts with the multiple parties, including the financial institution holding the failed mortgage. Eventually the NPL was obtained and subsequently converted into REO. Prior to and during the acquisition process, NdG initiated an in-depth structural, architectural, legal, and financial analysis of the building. A comprehensive re-development plan was developed, which incorporated a fully integrated sales, marketing, and operational strategy.

According to public opinion, the Intempo building was considered to be symbolic of the excesses in the Spanish real estate market preceding the GFC. Accordingly, NdG endeavored to ensure that the commercial and operational components of the building’s re-development plan incorporated a comprehensive re-branding of the project. RFPs were completed by ten architectural firms competing for the final design plan of the building. Moreover, NdG was able to obtain several substantial development financing bids from large financial institutions, including BBVA which had not been provided project financing since the onset of the financial crisis.

C: Results / Outcome

NdG successfully outpaced the projected timeframe. Our team managed the process and was able to take title, obtain financing, and provide the property free-and-clear of any incumbrances. Moreover, we secured the reactivation of the initial construction license, utility hookups, and operating permits. Through this acquisition, we afforded our U.S. partner with their first point of entry into the Spanish property market. NdG’s experience and industry relationships enabled our partner to successfully resolve the cultural barriers that international investors typically encounter when attempting a cross-border investment project of this scale. By preparing all the requisite groundwork while facilitating relationships with local operational entities and finance authorities, our partner was able to assume the management of one of the country’s most iconic properties.

Atocha - Historic work in progress In central Madrid

25 apartment units

‘As early entrants in the real estate cycle, we produced an excellent investment opportunity in one of the most dynamic locations of Madrid, with great value for money and excellent returns.’

Fernando Pijoan - Director Of Development & Infrastructure

A: Opportunity / Challenge

The Atocha building is a prestigious and historically significant property. It is centrally located in Madrid, near Santa Ana Square and close to Puerta del Sol, Plaza Mayor and the main museums, such as Prado and Reina Sofía. It was the working office of the “Atocha Lawyers” who suffered in a terrorist attack during the country’s transition to a modern constitutional monarchy in 1977.

The Atocha project was a ‘work in progress’ when it came to auction. It was the first project that we analyzed and successfully closed. Fortunately, the previous owner had completed most of the heavy- duty rehabilitation that involved turning the old wooden load- bearing wall structure into a new beam and pillar structure.

B: Project / Operations

We were familiar with the acquisition, underwriting, architectural and construction requirements of this project. Accordingly, upon completing a full review, we chose to retain the original architect, who was knowledgeable about the vital details regarding this historic structure. In similar fashion, we retained the primary contractor who provided valuable information regarding technical issues and construction budget projections.

Sales commenced shortly after the primary construction process was completed, and we had the opportunity to adjust price points and financial projections. Since we did not begin construction with a bank loan, the usual pre-sales covenants, which frequently lead to more conservative estimates and lower sales volumes, were not required. Once we achieved a reasonable sales volume and development was on track, we presented the project to Banco Sabadell, which structured a loan that enabled us to recover our capital investment and increase the IRR projections.

C: Results / Outcome

When we participated in the auction at the depth of the Great Financial Crisis, there were few market participants interested in rehabilitation projects. Accordingly, we were able to acquire the property at a remarkably attractive valuation. Accordingly, when the project was completed, we brought to market competitively priced and modernized apartments in an historic building located in the city center.

The team’s experience enabled us to capitalize upon the unprecedented property market dislocations and to complete a high- end development in Madrid, which resulted in excellent sales and superior returns for our investors.

Contact the real estate team